Hello Guys, Today i want to talk about a platform almost everybody must have eventually heard about but don't know how it works. ( Binary Option Trading ). Before i start my teachings, i want you to know that Binary Option Trading is different from Forex Trading but kind of similar.

Binary Option Trading is one of the fastest way and easiest way to make lots of money online but its kind of tedious to know how it really works. Some people believe it doesn't work but am here to tell you that it works so well. Am presently undergoing a month training which

i pay $1000 to train on it and i promise you guys to give you everything i learn. Binary option Trading have been around for a while now but recently (since 2008) have been a hit among the new traders. They were originally introduced as Digital Options and basically, binary means 2 values and in the case of finance mean up and down.

What Are Binary Options Trading?

It is a type of option in which the payoff is structured to be either a fixed amount of compensation if the option expires in the money, or nothing at all if the option expires out of the money. The success of a binary option is thus based on a YES/NO proposition.

Unlike Forex and sport betting and co, Binary options trading is based on either YES or NO. When you are on the profitable side of things, you can gain up to 85 percent of the amount you staked or risked. If you are wrong and have no rebate future with your broker, you will lose 100 percent of what you had staked or risked as usual. This means that for it to be profitable to you, you need to be right in your predictions more often than you are wrong.

Binary trading are classed as exotic options, yet binaries are extremely simple to use and understand functionally. The most common binary option is a "high-low" option. Providing access to stocks, indices, commodities and foreign exchange, a high-low binary option is also called a fixed-return option. This is because the option has an expiry date/time and also what is called a strike price. If a trader wagers correctly on the market's direction and the price at the time of expiry is on the correct side of the strike price, the trader is paid a fixed return regardless of how much the instrument moved. A trader who wagers incorrectly on the market's direction loses her/his investment.

If a trader believes the market is rising, she/he would purchase a "call." If the trader believes the market is falling, she/he would buy a "put." For a call to make money, the price must be above the strike price at the expiry time. For a put to make money, the price must be below the strike price at the expiry time. The strike price, expiry, payout and risk are all disclosed at the trade's outset. For most high-low binary options outside the U.S., the strike price is the current price or rate of the underlying financial product, such as the S&P 500 index, EUR/USD currency pair or a particular stock. Therefore, the trader is wagering whether the future price at expiry will be higher or lower than the current price.

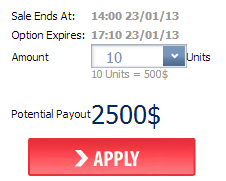

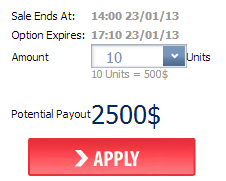

When you want to start trading, the platform will differ a little bit from broker to broker, but your basic interface will be the same. When you want to start trading, First, you select an asset. Then you select which direction you think it will go (up/call, or down/put). Next you figure out your time frames. Do you want to have a quick 60second trade? or do you want to choose an expiration time 30 minutes from now?

Your brokerage should help you to easily pick an expiry from a list near the asset you have selected. Finally, you want to decide how much to risk. Some brokers have a minimum of $5 or $10 per trade. If you’re new, you will want to start out as small as possible until you have refined your technique. Next, when you’re sure that everything is the way you want it, you hit the button that executes the trade for you. Then, you just sit back and wait to see if you were right or wrong.

There are two types of options. They Are

1. The Call Option

2. The Put Option

The call option is what you will use when you think that the price of the asset in question will go up. You utilize the put option when you think the price will be going down.

This is extremely simple to learn—only one of two things can happen. You are either right and you see a profit returned to you, or you are wrong and you lose your risked money. This creates an illusion of simplicity. Binaries might be simple in how profits and losses are set up, but this is where they stop being easy. If you want to be successful trading, you need to have a mastery over chart interpretation, sentimental and technical analysis tools, and even have a good eye for spotting significant fundamental trades.

This is extremely simple to learn—only one of two things can happen. You are either right and you see a profit returned to you, or you are wrong and you lose your risked money. This creates an illusion of simplicity. Binaries might be simple in how profits and losses are set up, but this is where they stop being easy. If you want to be successful trading, you need to have a mastery over chart interpretation, sentimental and technical analysis tools, and even have a good eye for spotting significant fundamental trades.

The Ups and Dows Of Binary Option

There is an upside to these trading instruments, but it requires some perspective. A major advantage is that the risk and reward are known. It does not matter how much the market moves in favor or against the trader. There are only two outcomes: win a fixed amount or lose a fixed amount. Also, there are generally no fees, such as commissions, with these trading instruments (brokers may vary). The options are simple to use, and there is only one decision to make: Is the underlying asset going up or down? There are also no liquidity concerns, because the trader never actually owns the underlying asset, and therefore brokers can offer innumerable strike prices and expiration times/dates, which is attractive to a trader. A final benefit is that a trader can access multiple asset classes in global markets generally anytime a market is open somewhere in the world.

The major drawback of high-low binary options is that the reward is always less than the risk. This means a trader must be right a high percentage of the time to cover losses. While payout and risk will fluctuate from broker to broker and instrument to instrument, one thing remains constant: Losing trades will cost the trader more than she/he can make on winning trades. Other types of binary options (not high-low) may provide payouts where the reward is potentially greater than the risk.

Above everything, you always will want to make sure that you are comfortable with the trade and confident in your decision making ability. When you start having doubts about whether or not your system works, or if you are nervous because you risked too much money, your emotions start to come into play. Poker players call this tilt because it skews their judgment making ability. When your emotions become a factor in your trading, logic and research take a back seat, thus making it harder to be successful. Emotions have no place in trading of any sort; you want to be as rational as possible. If you are starting to have deep feelings come up while you are trading, it’s time to take a break. You can always come back when you are ready.

Watch out for my next post on Binary Options Trading.

Binary Option Trading is one of the fastest way and easiest way to make lots of money online but its kind of tedious to know how it really works. Some people believe it doesn't work but am here to tell you that it works so well. Am presently undergoing a month training which

i pay $1000 to train on it and i promise you guys to give you everything i learn. Binary option Trading have been around for a while now but recently (since 2008) have been a hit among the new traders. They were originally introduced as Digital Options and basically, binary means 2 values and in the case of finance mean up and down.

What Are Binary Options Trading?

It is a type of option in which the payoff is structured to be either a fixed amount of compensation if the option expires in the money, or nothing at all if the option expires out of the money. The success of a binary option is thus based on a YES/NO proposition.

Unlike Forex and sport betting and co, Binary options trading is based on either YES or NO. When you are on the profitable side of things, you can gain up to 85 percent of the amount you staked or risked. If you are wrong and have no rebate future with your broker, you will lose 100 percent of what you had staked or risked as usual. This means that for it to be profitable to you, you need to be right in your predictions more often than you are wrong.

Binary trading are classed as exotic options, yet binaries are extremely simple to use and understand functionally. The most common binary option is a "high-low" option. Providing access to stocks, indices, commodities and foreign exchange, a high-low binary option is also called a fixed-return option. This is because the option has an expiry date/time and also what is called a strike price. If a trader wagers correctly on the market's direction and the price at the time of expiry is on the correct side of the strike price, the trader is paid a fixed return regardless of how much the instrument moved. A trader who wagers incorrectly on the market's direction loses her/his investment.

If a trader believes the market is rising, she/he would purchase a "call." If the trader believes the market is falling, she/he would buy a "put." For a call to make money, the price must be above the strike price at the expiry time. For a put to make money, the price must be below the strike price at the expiry time. The strike price, expiry, payout and risk are all disclosed at the trade's outset. For most high-low binary options outside the U.S., the strike price is the current price or rate of the underlying financial product, such as the S&P 500 index, EUR/USD currency pair or a particular stock. Therefore, the trader is wagering whether the future price at expiry will be higher or lower than the current price.

When you want to start trading, the platform will differ a little bit from broker to broker, but your basic interface will be the same. When you want to start trading, First, you select an asset. Then you select which direction you think it will go (up/call, or down/put). Next you figure out your time frames. Do you want to have a quick 60second trade? or do you want to choose an expiration time 30 minutes from now?

Your brokerage should help you to easily pick an expiry from a list near the asset you have selected. Finally, you want to decide how much to risk. Some brokers have a minimum of $5 or $10 per trade. If you’re new, you will want to start out as small as possible until you have refined your technique. Next, when you’re sure that everything is the way you want it, you hit the button that executes the trade for you. Then, you just sit back and wait to see if you were right or wrong.

Types of Options

There are two types of options. They Are

1. The Call Option

2. The Put Option

The call option is what you will use when you think that the price of the asset in question will go up. You utilize the put option when you think the price will be going down.

This is extremely simple to learn—only one of two things can happen. You are either right and you see a profit returned to you, or you are wrong and you lose your risked money. This creates an illusion of simplicity. Binaries might be simple in how profits and losses are set up, but this is where they stop being easy. If you want to be successful trading, you need to have a mastery over chart interpretation, sentimental and technical analysis tools, and even have a good eye for spotting significant fundamental trades.

This is extremely simple to learn—only one of two things can happen. You are either right and you see a profit returned to you, or you are wrong and you lose your risked money. This creates an illusion of simplicity. Binaries might be simple in how profits and losses are set up, but this is where they stop being easy. If you want to be successful trading, you need to have a mastery over chart interpretation, sentimental and technical analysis tools, and even have a good eye for spotting significant fundamental trades.The Ups and Dows Of Binary Option

There is an upside to these trading instruments, but it requires some perspective. A major advantage is that the risk and reward are known. It does not matter how much the market moves in favor or against the trader. There are only two outcomes: win a fixed amount or lose a fixed amount. Also, there are generally no fees, such as commissions, with these trading instruments (brokers may vary). The options are simple to use, and there is only one decision to make: Is the underlying asset going up or down? There are also no liquidity concerns, because the trader never actually owns the underlying asset, and therefore brokers can offer innumerable strike prices and expiration times/dates, which is attractive to a trader. A final benefit is that a trader can access multiple asset classes in global markets generally anytime a market is open somewhere in the world.

The major drawback of high-low binary options is that the reward is always less than the risk. This means a trader must be right a high percentage of the time to cover losses. While payout and risk will fluctuate from broker to broker and instrument to instrument, one thing remains constant: Losing trades will cost the trader more than she/he can make on winning trades. Other types of binary options (not high-low) may provide payouts where the reward is potentially greater than the risk.

Conclusion:

Above everything, you always will want to make sure that you are comfortable with the trade and confident in your decision making ability. When you start having doubts about whether or not your system works, or if you are nervous because you risked too much money, your emotions start to come into play. Poker players call this tilt because it skews their judgment making ability. When your emotions become a factor in your trading, logic and research take a back seat, thus making it harder to be successful. Emotions have no place in trading of any sort; you want to be as rational as possible. If you are starting to have deep feelings come up while you are trading, it’s time to take a break. You can always come back when you are ready.

Watch out for my next post on Binary Options Trading.

0 comments: